Hey everyone! It’s incredible to see how fast the world of investing is evolving, isn’t it? For the longest time, the focus was almost purely on financial returns, but let’s be real, times have changed.

We’re now living in an era where our wallets can actually be powerful tools for positive change, and that’s something I find incredibly exciting. I mean, with climate change making headlines almost daily and its impacts becoming undeniable, the pressure is on for everyone, including investors, to step up.

It’s not just about doing good; it’s increasingly clear that investing responsibly, especially when it comes to environmental factors, makes sound financial sense too.

When I first started diving deep into what’s now broadly known as Socially Responsible Investing, or SRI, it completely reshaped my perspective. It’s truly fascinating how this approach integrates environmental, social, and governance (ESG) considerations into investment decisions.

We’re talking about everything from companies leading the charge in renewable energy to those actively working to reduce their carbon footprint. Sure, there’s always chatter about “greenwashing” and how to truly discern impact, but the sheer momentum behind this movement, with countless funds and innovative solutions popping up, signals a massive shift.

I’ve personally seen how a thoughtful investment strategy can align with my values without sacrificing potential growth, and that’s a game-changer. It’s an opportunity to support businesses that are building a more sustainable future, right from the ground up, while navigating the financial risks and opportunities presented by a changing climate.

So, are you ready to explore how your investments can play a part in addressing one of the biggest challenges of our time while potentially boosting your portfolio?

Let’s dive deeper and accurately uncover how to make your money work harder for both you and the planet.

Navigating the Green Investment Landscape: More Than Just a Trend

It’s genuinely thrilling to witness how much the conversation around investing has shifted over the past few years. What once felt like a niche concern for a select few is now a mainstream topic: how our money can actually make a difference in the fight against climate change.

I remember when I first started exploring this area, the sheer volume of information felt overwhelming, and honestly, a bit daunting. But as I dove deeper, I realized this isn’t just about altruism; it’s about smart, forward-thinking financial planning.

We’re seeing real, tangible shifts in global markets as companies grapple with everything from carbon taxes to consumer demand for sustainable products.

This isn’t just about feeling good about where your money goes; it’s about positioning your portfolio for resilience and growth in a world that is fundamentally changing.

From renewable energy projects to innovations in sustainable agriculture, the opportunities are vast and exciting, offering a chance to invest in the solutions rather than perpetuate the problems.

My own journey into this space has shown me that aligning my investments with my values doesn’t mean sacrificing returns; it often means finding new avenues for long-term value creation.

Understanding the Climate Imperative for Investors

Let’s be honest, climate change isn’t some distant threat anymore; it’s here, impacting everything from supply chains to insurance premiums. As investors, ignoring this reality would be incredibly short-sighted, almost negligent.

Think about the increasing frequency of extreme weather events – wildfires, floods, droughts – and their economic fallout. These aren’t just headlines; they represent real financial risks and opportunities.

Companies that are slow to adapt, clinging to outdated, carbon-intensive business models, face significant regulatory and reputational hurdles. On the flip side, those innovating in clean technologies, resource efficiency, and sustainable practices are often poised for substantial growth.

I’ve personally seen how a company’s proactive stance on environmental stewardship can enhance its brand value and attract a new generation of conscious consumers and investors.

It’s about recognizing that environmental health is intrinsically linked to economic health, and our investment decisions need to reflect that understanding.

Beyond “Greenwashing”: Identifying True Impact

One of the biggest concerns I’ve heard from fellow investors, and frankly, something I grappled with myself, is the fear of “greenwashing.” How do you really tell if a company or a fund is genuinely committed to sustainability, or if they’re just slapping a “green” label on their existing practices for marketing purposes?

It’s a valid question, and it requires a bit of digging. My advice is always to look past the marketing fluff and dig into the data. Are they setting clear, measurable environmental targets?

Are they transparent about their carbon footprint and resource usage? Do independent third parties verify their claims? I’ve found that the companies truly committed to climate action are usually the most open about their progress and their challenges.

They integrate sustainability into their core business strategy, not just as a peripheral CSR initiative. It’s about finding businesses that aren’t just talking the talk, but genuinely walking the walk, and that often means looking for strong governance and clear accountability.

The Rise of Sustainable Funds and Investment Vehicles

It’s truly incredible to witness the explosion of sustainable investment options available to us today. Just a decade ago, finding genuine “green” funds felt like searching for a needle in a haystack, often with higher fees and limited track records.

Now, however, the landscape has completely transformed, offering a dizzying array of choices, from actively managed ESG funds to passive index trackers focused on renewable energy or water conservation.

This isn’t just a fleeting trend; it’s a fundamental shift in how investment products are structured and marketed, driven by both investor demand and a growing understanding among financial institutions that climate risk is investment risk.

I’ve spent countless hours sifting through prospectuses and performance reports, and what’s clear is that the competition among these funds is driving innovation and, crucially, offering more competitive returns.

It’s no longer about choosing between your values and your wallet; it’s about finding synergy between the two. The diversification benefits of these funds can also be significant, as they often tap into emerging industries and technologies that are less correlated with traditional sectors.

Demystifying ESG Integration in Portfolios

When we talk about sustainable funds, often the term “ESG integration” pops up. For those new to it, ESG stands for Environmental, Social, and Governance, and it’s essentially a framework for evaluating companies beyond traditional financial metrics.

Instead of just looking at profits and losses, ESG integration means also considering a company’s environmental impact, its social responsibility (think labor practices, community engagement), and its governance structure (board diversity, executive pay).

My personal experience has been that companies with strong ESG profiles tend to be more resilient in the long run. They often have better risk management, stronger reputations, and a more engaged workforce.

When I’m looking at a fund, I’m trying to understand how deeply they incorporate these factors into their investment decision-making. Is it just a screen to exclude certain industries, or are they actively seeking out companies that are leaders in their respective ESG categories?

This deeper dive helps me feel more confident that my investments are truly aligned with a more sustainable future.

Passive vs. Active: Finding Your Sustainable Niche

Choosing between passive and active funds in the sustainable space can feel a bit like picking between two delicious desserts. Both have their merits, and what works best really depends on your investment philosophy and how hands-on you want to be.

Active sustainable funds often have dedicated teams of analysts who conduct deep research into companies’ ESG practices, aiming to identify true leaders and potentially outperform the market.

For me, the appeal here is the potential for discovering genuinely impactful companies that might be overlooked by broader indices. However, these funds typically come with higher management fees.

On the other hand, passive sustainable ETFs or index funds track a specific ESG-focused index, offering broad market exposure to companies that meet certain sustainability criteria, usually at a much lower cost.

They provide an easy, diversified way to get exposure to the green economy without having to pick individual stocks. I’ve personally used a mix of both, depending on my conviction in specific themes or sectors, finding that passive funds are great for core holdings, while active funds allow for more targeted impact.

Unlocking the Financial Upside of Climate-Focused Investing

I think one of the most exciting aspects of investing with a climate lens is realizing that it’s not just about mitigating risks; it’s profoundly about tapping into massive growth opportunities.

The transition to a low-carbon economy isn’t a cost center; it’s a multi-trillion-dollar economic transformation. We’re talking about entirely new industries emerging, from advanced battery storage and electric vehicles to carbon capture technologies and sustainable infrastructure.

As an investor, being at the forefront of this shift feels like being part of something truly revolutionary, a chance to invest in the companies that are building the future.

I’ve seen some incredible success stories in my own portfolio from companies that were once considered niche, but are now leading innovators in their fields.

The financial community is increasingly recognizing that climate solutions are not just “nice to haves” but essential components of future economic prosperity.

This perspective has fundamentally changed how I view market opportunities and where I choose to allocate my capital.

Spotting Growth in Renewable Energy and Clean Technology

If there’s one sector that consistently excites me when it comes to climate-focused investing, it’s renewable energy and clean technology. The advancements we’re seeing in solar, wind, geothermal, and hydro power are just breathtaking, and the cost of these technologies has plummeted, making them increasingly competitive with fossil fuels.

It’s not just about power generation either; think about the entire ecosystem – energy storage, smart grids, electric vehicle infrastructure, and even green hydrogen.

These are all areas ripe with innovation and significant growth potential. I personally get a thrill from researching companies that are developing the next generation of these technologies, imagining the impact they’ll have.

It’s not always a straight line to success, as with any emerging market, but the long-term trends and policy support worldwide paint a very compelling picture.

Investing in this space feels like participating in a global revolution that is both environmentally necessary and economically lucrative.

Resilience: The Hidden Benefit of Sustainable Business Models

Beyond the direct growth opportunities, one crucial aspect I’ve come to appreciate about climate-focused investments is the inherent resilience of sustainable business models.

Companies that actively manage their environmental impact, optimize resource use, and innovate towards greener solutions often exhibit greater long-term stability.

They are typically better prepared for regulatory changes, less susceptible to resource price volatility, and more attractive to a growing segment of conscious consumers.

I’ve found that these companies often have stronger management teams, too, as they are forced to think strategically about long-term sustainability rather than just short-term gains.

This resilience translates directly into reduced investment risk, which is something every investor should appreciate. In an increasingly unpredictable world, backing businesses that are built to last, by adapting to and addressing environmental challenges, seems like a profoundly smart move.

Diversifying Your Portfolio with Climate Resilience

Building a truly robust portfolio in today’s world, for me, absolutely has to include a strong element of climate resilience. It’s not just about picking a few “green” stocks; it’s about integrating this mindset across various asset classes and sectors.

Think about it: every industry, from agriculture to real estate to technology, will be impacted by climate change in some way, shape, or form. Therefore, considering how different companies and sectors are adapting to this new reality becomes a critical part of diversification.

I’ve spent a lot of time re-evaluating my own asset allocation through this lens, looking for opportunities to support companies that are not only minimizing their negative impact but are actively contributing to solutions.

This could mean investing in innovative water management companies, sustainable forestry, or even businesses focused on circular economy principles. It’s about building a portfolio that is robust enough to weather future environmental challenges and capitalize on the opportunities they present.

Real Estate and Infrastructure: Building a Greener Tomorrow

When I think about climate-resilient investing, my mind often turns to real estate and infrastructure. These are tangible assets that are directly exposed to physical climate risks but also offer massive opportunities for transformation.

Imagine investing in smart, energy-efficient buildings that use renewable power and advanced insulation, or infrastructure projects that support sustainable transportation and climate adaptation.

The long-term nature of these investments means they’re often at the forefront of incorporating green building standards and resilient design. I’ve seen firsthand how properties with strong sustainability credentials can command higher rents and valuations, making them financially attractive beyond their environmental benefits.

It’s an area where your investment can literally help build the physical foundations of a more sustainable future, from a new renewable energy grid to resilient coastal infrastructure.

This kind of tangible impact really resonates with me.

Agriculture and Food Systems: Investing in Sustainable Sustenance

Another area that I believe is critically important for climate-focused investing is agriculture and food systems. This sector is not only highly vulnerable to climate change but also a significant contributor to greenhouse gas emissions.

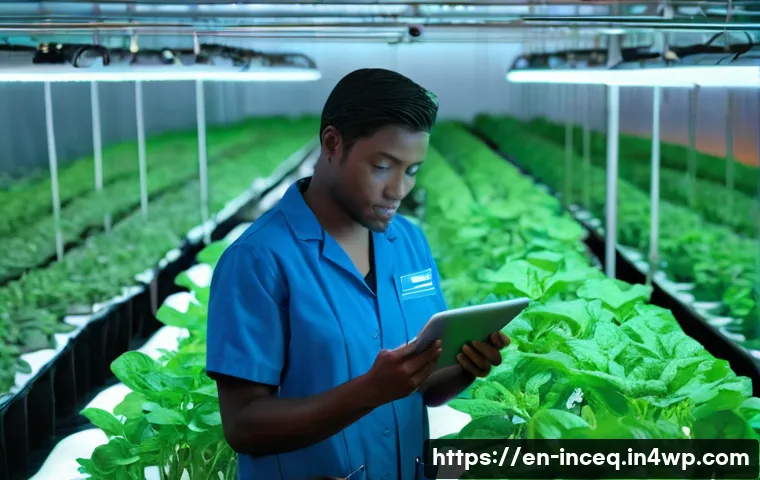

However, it’s also ripe for innovation and offers incredible opportunities for positive impact. I’m talking about companies developing sustainable farming practices, alternative proteins, vertical farming technologies, and solutions for reducing food waste.

The demand for sustainable and ethically produced food is soaring, and investing in companies that are pioneering these solutions feels incredibly strategic.

It’s about ensuring food security while simultaneously reducing environmental impact. My own exploration in this space has introduced me to some truly groundbreaking businesses that are rethinking how we grow, process, and consume food, and I find that immensely inspiring as both an investor and a consumer.

The Personal Impact: Aligning Values with Wealth

For me, one of the most profound aspects of climate-focused investing isn’t just the financial gains or the intellectual challenge; it’s the deep sense of alignment it brings between my personal values and my financial decisions.

There’s a real satisfaction that comes from knowing that my money isn’t just sitting idly by, but is actively working to support businesses and innovations that are making the world a better place.

It transforms investing from a purely transactional activity into something far more meaningful and empowering. I used to feel a disconnect, wanting to live a sustainable lifestyle but feeling my investments were out of sync.

Now, that gap has narrowed considerably, and it genuinely feels good. It’s about leveraging the power of our capital to drive systemic change, one investment at a time.

This personal connection makes me a more engaged and, I believe, a more successful investor in this space.

Beyond Financial Returns: The Broader Ripple Effect

While financial returns are always a key consideration, I’ve found that the benefits of climate-focused investing extend far beyond just the numbers in my brokerage account.

There’s a broader ripple effect that’s incredibly inspiring. When we invest in sustainable companies, we’re not just funding their growth; we’re sending a powerful signal to the market.

We’re telling corporations that environmental responsibility matters, that innovation in sustainability is rewarded, and that consumers and investors alike demand better.

This collective action can accelerate the transition to a low-carbon economy much faster than individual efforts alone. I personally feel a sense of purpose knowing that my investment choices contribute to this larger movement, helping to shape a more sustainable future for everyone.

It’s a testament to the idea that individual actions, when aggregated, can lead to monumental change.

Building a Legacy: Investing for Future Generations

Thinking about climate change can sometimes feel overwhelming, particularly when we consider the legacy we’re leaving for future generations. That’s why, for me, climate-focused investing has become such an important part of building a meaningful legacy.

It’s about investing not just for my own financial future, but for the well-being of my children and grandchildren, and indeed, for all future inhabitants of this planet.

When I look at my portfolio, I see not just stocks and bonds, but stakes in companies that are actively building a more resilient, sustainable world. It’s a tangible way to contribute to a positive future, showing that we were willing to put our money where our values are.

This long-term perspective, looking beyond immediate gains to the lasting impact, truly enriches the entire investment journey.

The Smart Investor’s Toolkit for Climate Action

Getting started with climate-focused investing might seem complex, but thankfully, there are so many resources and tools available now to help make it approachable.

It’s not about being an environmental scientist or a financial guru; it’s about making informed choices based on available information. My journey has involved a lot of reading, researching, and sometimes, learning from my own missteps.

The key is to approach it with a curious mind and a willingness to learn. There are incredible platforms, reports from financial institutions, and even dedicated websites that rank funds and companies based on their ESG performance.

Utilizing these resources effectively can significantly streamline your decision-making process and help you identify genuinely impactful investment opportunities.

It really comes down to arming yourself with the right information to navigate this evolving landscape confidently.

Leveraging Research and Rating Agencies for Informed Decisions

When I first started delving into climate-focused investing, I quickly realized that I needed reliable sources to cut through the noise. That’s where independent research and rating agencies become invaluable.

Companies like MSCI, Sustainalytics, and CDP (Carbon Disclosure Project) provide comprehensive ESG ratings and data that can help you evaluate a company’s environmental performance and overall sustainability efforts.

These ratings often look at things like carbon emissions, water usage, waste management, and renewable energy adoption. I’ve found that checking these ratings gives me a much clearer picture than relying solely on a company’s own marketing materials.

It’s like having a trusted guide helping you navigate a dense forest, pointing out which trees are truly strong and which might just be painted green.

Taking the time to consult these resources can genuinely make a huge difference in the quality and impact of your investments.

Considering Impact Investing and Thematic Funds

For those who want to go beyond just ESG screening and aim for direct, measurable positive impact, impact investing and thematic funds are fantastic options.

Impact investing is all about making investments with the explicit intention to generate positive, measurable social and environmental impact alongside a financial return.

This could mean investing in a fund specifically dedicated to clean water solutions, affordable housing, or microfinance. Thematic funds, on the other hand, focus on specific themes like renewable energy, sustainable agriculture, or the circular economy, providing concentrated exposure to sectors driving climate solutions.

I’ve personally found that these types of investments offer a unique blend of financial opportunity and a clear sense of purpose. It’s about being deliberate with your capital, directing it towards the areas where you believe it can make the biggest difference, while still aiming for competitive returns.

| Investment Focus Area | Why It Matters for Climate Action | Potential Investment Vehicles |

|---|---|---|

| Renewable Energy Generation | Directly replaces fossil fuels, reducing greenhouse gas emissions. Critical for decarbonizing electricity grids. | ETFs/Mutual Funds focused on solar, wind, geothermal; individual utility stocks transitioning to renewables. |

| Sustainable Transportation | Reduces emissions from vehicles through electrification and efficient public transport. | Electric vehicle manufacturers, battery technology companies, public transport infrastructure funds. |

| Green Building & Infrastructure | Minimizes energy consumption in buildings and develops climate-resilient urban systems. | REITs with green building certifications, infrastructure funds investing in sustainable projects. |

| Circular Economy Solutions | Reduces waste, promotes recycling, and optimizes resource use, lessening demand for new raw materials. | Companies in waste management, recycling technologies, sustainable packaging, repair services. |

| Sustainable Agriculture & Food | Addresses emissions from farming, promotes biodiversity, and ensures food security in a changing climate. | Agri-tech companies, plant-based food innovators, sustainable forestry funds. |

Overcoming Challenges and Staying Ahead of the Curve

Let’s be real, no investment journey is entirely without its bumps, and climate-focused investing is no exception. There are definitely challenges to navigate, from weeding out genuine impact from “greenwashing” to dealing with the inherent volatility of emerging sectors.

But honestly, that’s part of what makes it so engaging. The market is constantly evolving, new technologies are emerging, and regulatory frameworks are shifting.

Staying informed and adaptable is key. My personal approach has always been to view these challenges not as roadblocks, but as opportunities for deeper research and more strategic thinking.

It’s about being patient, understanding that true transformation takes time, and celebrating the incremental progress along the way. For me, the long-term vision of a sustainable future far outweighs any short-term hurdles.

It’s about being proactive and positioning your portfolio to thrive in the economy of tomorrow, rather than being caught off guard by the changes of today.

Addressing “Greenwashing” Concerns with Diligence

I’ve already touched on greenwashing, but it’s such a significant concern that it bears repeating: diligence is absolutely paramount. It’s not just about what a company says, but what it *does*.

I always advise looking for companies with measurable goals, transparent reporting, and third-party verification of their sustainability claims. Are they reporting to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD)?

Do they have clear emissions reduction targets validated by initiatives like the Science Based Targets initiative (SBTi)? My experience has shown me that truly sustainable companies are usually the most open to scrutiny, understanding that trust is built on transparency.

If a company’s environmental claims feel vague or too good to be true, it’s probably worth digging deeper or looking elsewhere. Your money is a powerful tool, and you want to make sure it’s supporting genuine change, not just clever marketing.

The Evolving Landscape of Climate Policy and Regulation

One of the more dynamic aspects of climate-focused investing is keeping an eye on the ever-evolving landscape of climate policy and regulation. Governments worldwide are increasingly implementing carbon pricing, stricter emissions standards, and incentives for renewable energy and green technologies.

These policies can have a profound impact on industries and individual companies, creating both risks and opportunities for investors. For example, a new carbon tax might penalize high-emission industries, while subsidies for electric vehicles could boost the automotive sector’s transition.

I’ve found that staying informed about these policy shifts, whether through financial news or dedicated policy briefings, is crucial for making informed investment decisions.

It’s about understanding the tailwinds and headwinds that different sectors face and adjusting your strategy accordingly. This proactive approach helps in staying ahead of the curve and positioning your investments for success in a world increasingly shaped by environmental policy.

글을마치며

Whew, what a journey we’ve shared today, diving deep into the fascinating world of climate-focused investing! It’s genuinely a topic that ignites my passion, not just as an investor, but as someone who deeply cares about the planet we call home. What started for me as a curious exploration has truly transformed into a core part of my financial philosophy, and frankly, my life. There’s an undeniable satisfaction that comes from knowing your hard-earned money isn’t just growing, but is actively contributing to solutions for some of the biggest challenges of our time. It’s about more than just numbers on a screen; it’s about building a legacy, fostering innovation, and championing the kind of future we all want to see. I sincerely hope this deep dive has demystified some aspects for you and, perhaps, even sparked a new interest or solidified an existing conviction. Remember, every dollar we invest with intention has the power to create a ripple effect, driving systemic change and making a tangible difference in the world. It’s an empowering feeling, one I believe every investor can and should experience.

알아두면 쓸모 있는 정보

Quick Tips for Your Green Investment Journey

1. Start Small and Learn Continuously: Don’t feel pressured to overhaul your entire portfolio overnight. Begin by researching a few sustainable funds or companies that align with your personal values and interests. The learning curve can be steep, but there are countless resources, from financial news sites to specialized ESG rating agencies, that can help you along the way. Your journey into climate-focused investing is a marathon, not a sprint, so embrace the process of continuous learning and adaptation. As you gain confidence and understanding, you can gradually expand your green holdings.

2. Diversify Your Climate Investments: Just like with any investment strategy, diversification is absolutely key. Don’t put all your eggs in one “green” basket. Look beyond just renewable energy stocks and consider companies involved in sustainable agriculture, water management, circular economy solutions, or green infrastructure. Spreading your investments across various climate-solution sectors can help mitigate risks associated with any single industry and potentially enhance your long-term returns. It’s about building a resilient portfolio that can withstand market fluctuations while still driving positive impact.

3. Scrutinize for Genuine Impact (Avoid Greenwashing): This is crucial! As the demand for sustainable investments grows, so does the risk of “greenwashing” – companies or funds making exaggerated or misleading claims about their environmental credentials. Always look beyond marketing slogans. Dig into a company’s detailed sustainability reports, check their ESG ratings from independent third parties, and evaluate their measurable environmental targets. Transparency and verifiable data are your best friends here. Your capital is powerful, so ensure it’s supporting authentic change and not just a clever PR campaign.

4. Stay Informed on Policy and Regulation: Climate policy and regulations are constantly evolving globally, and these shifts can significantly impact the investment landscape. New carbon taxes, subsidies for green technologies, or stricter environmental standards can create both opportunities and risks for different sectors. Keeping an eye on developments from international agreements to local government initiatives can give you a strategic edge. Financial news outlets and dedicated policy research firms often provide excellent summaries, helping you to anticipate market movements and adjust your investment strategy accordingly.

5. Adopt a Long-Term Perspective: Climate change is a long-term challenge, and investing in solutions demands a similar long-term mindset. While there can be short-term market volatility in emerging green sectors, the fundamental trends driving the transition to a low-carbon economy are robust and enduring. Companies that are genuinely committed to sustainability are often building resilient business models for the future, making them excellent long-term holdings. Patience, combined with a conviction in the importance of your investments, will be your greatest asset in this space, allowing you to ride out the inevitable market ups and downs.

중요 사항 정리

To wrap things up, remember that navigating the green investment landscape isn’t just about following a trend; it’s about embracing a forward-thinking, resilient approach to wealth creation that aligns with a better future. The transition to a low-carbon economy is creating unprecedented growth opportunities in sectors like renewable energy, sustainable transportation, and circular economy solutions. By integrating Environmental, Social, and Governance (ESG) factors into your decision-making, you’re not only mitigating risks but also identifying companies poised for long-term success. The fear of “greenwashing” is valid, but with diligent research and the use of independent rating agencies, you can pinpoint true impact. Most importantly, climate-focused investing offers a profound personal impact, allowing you to align your financial goals with your deepest values, contributing to a meaningful legacy for generations to come. This isn’t just smart investing; it’s investing with purpose, and that, for me, makes all the difference.

Frequently Asked Questions (FAQ) 📖

Q: What exactly does “environmental investing” mean, and how does it go beyond just solar panels or wind farms?

A: That’s such a great question because, when I first started exploring this space, my mind immediately went to the most obvious things like renewable energy companies.

And while those are absolutely crucial, the “environmental” aspect of ESG investing is so much broader and more fascinating! It really encompasses how a company interacts with the natural world and manages its impact.

We’re talking about everything from a company’s carbon emissions and energy efficiency to its water usage, waste management, and even its efforts in sustainable sourcing and biodiversity protection.

Think about businesses innovating in green building materials, developing electric vehicle technology, creating solutions for efficient agriculture, or even those focusing on circular economy principles to reduce waste.

It’s about supporting companies that are not just doing less harm, but actively creating solutions for a more sustainable planet. For me, the eye-opener was realizing how deeply integrated these environmental considerations are into a company’s long-term viability and innovation potential, way beyond just the visible green tech.

Q: I’m genuinely interested in making my investments more environmentally friendly, but honestly, how do I actually start without falling for “greenwashing”? It feels like everyone claims to be “green” these days!

A: Oh, I hear you loud and clear on the greenwashing concern – it’s a completely valid challenge, and something I’ve learned to navigate carefully myself!

When I first tried to identify truly impactful investments, I felt a bit overwhelmed by all the marketing buzz. The trick is to look beyond the flashy slogans and dig into the real data.

A great starting point is to utilize independent ESG ratings from reputable research firms. Companies like MSCI, Sustainalytics, and CDP (Carbon Disclosure Project) provide objective analyses of how well companies are performing on environmental metrics.

I personally like to cross-reference a few of these if I can. Beyond that, don’t be afraid to actually read a company’s annual sustainability report. Look for concrete goals, measurable progress, and transparent reporting.

Are they just talking about being green, or are they setting ambitious net-zero targets and investing in new, sustainable processes? You can also explore specific environmentally focused ETFs (Exchange Traded Funds) or mutual funds, but always scrutinize their holdings to make sure they align with your values and aren’t just a mix of everything.

My biggest takeaway? Do your homework, trust independent evaluators, and don’t just take a company’s word for it – look for verifiable action!

Q: This all sounds wonderful, but let’s be pragmatic for a second: will I really have to sacrifice my financial returns if I prioritize the planet with my investments? I still need my money to grow, after all!

A: This is hands down the question I get asked most often, and it’s a perfectly natural concern! For years, there was this lingering myth that “doing good” meant “doing less well” financially.

I used to worry about it too, wondering if I’d be leaving money on the table. But honestly, what I’ve learned, and what the data increasingly shows, is that this simply isn’t the case anymore – and often, it’s quite the opposite!

Companies that are serious about their environmental impact often demonstrate superior risk management, greater innovation, and a stronger focus on long-term sustainability.

These qualities can actually translate into more resilient performance and even competitive returns. Think about it: businesses leading the charge in clean energy or sustainable supply chains are often ahead of regulatory changes and consumer demand shifts.

They’re building for the future, not just the next quarter. I’ve personally seen my environmentally-focused investments perform right alongside, and sometimes even outperform, some of my more traditional holdings.

It’s a powerful combination: your money can truly contribute to a healthier planet and potentially boost your portfolio at the same time. It’s truly a win-win in today’s evolving market.